Clinton also dominates local cable, which Trump has largely ignored

Over 3.3M airings in 2016 Cycle;

Nearly $600 million in ads for Senate races

November 3, 2016

![]()

Report Highlights

President

• Clinton crushes Trump 3:1 on air (Table 1)

• Presidential volume comparison from the last two weeks (Table A1)

• NEW: WMP reports local cable airings from 2016 and 2012 (Table 2)

• MAP: Large Clinton advantages on air persist in last two weeks (Figure 1)

• Clinton dominates top markets including Orlando, Tampa, Las Vegas (Table 3)

• MAP: Geographic comparison of presidential ad volumes from 2012 and 2016 (Figure 2)

• Bernie Sanders has aired more ads than Donald Trump (Table 4)

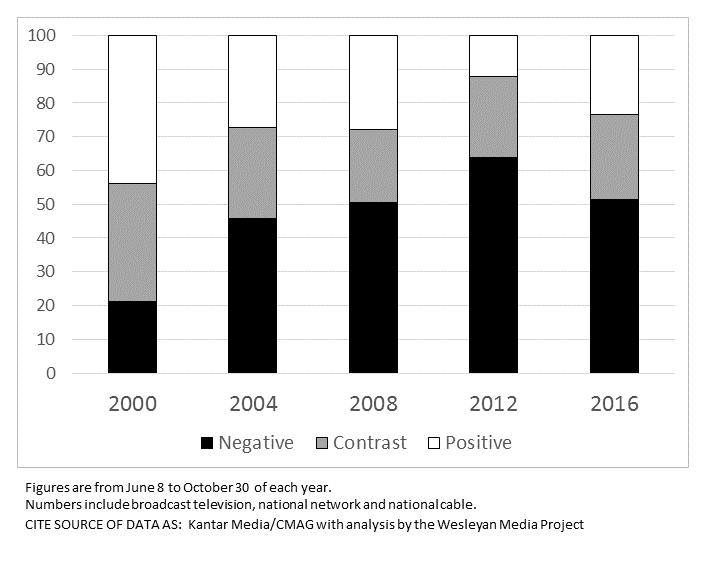

• 2016 pres general election ads have been more positive than 2012 (Figure 3)

• Clinton More, Trump Less Likely to Feature Opponent’s Voice in Ads in the Closing Weeks (Table 5)

• Issues in presidential ads have varied depending on ad sponsor (Table 6)

Cycle-to-Date 2016 Totals

• 3.3M in airings and an estimated $2.4B spent in total 2016 cycle (Table 7)

• Top outside group advertisers in 2015-2016 cycle (Table 18)

US Senate

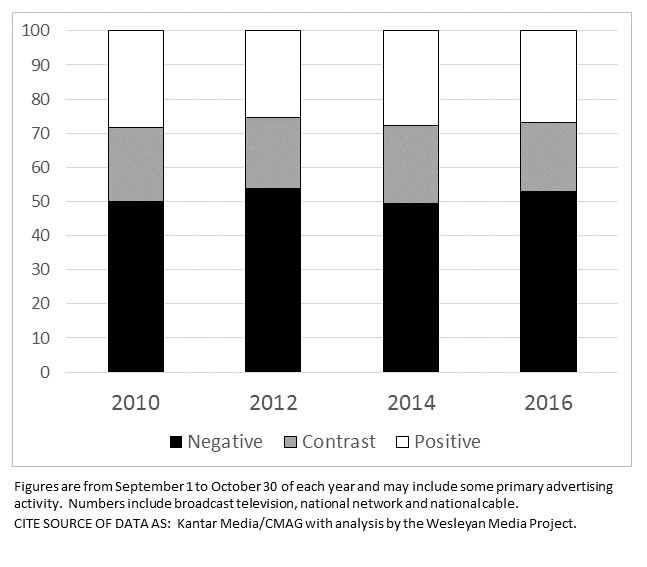

• Volume over time (Figure 4); tone over time (Figure 5)

• Senate ads featuring presidential candidates (Table 8); and issues (Table 9)

• Top Senate races cycle-to-date (Table 10); last two weeks (Table 11)

• Least positive Senate races (Table 12)

US House

• Top House races cycle-to-date (Table 13); last two weeks (Table 14)

• Least positive House races (Table 15)

Governor

• Top Governors races – last two weeks (Table 16)

• Least positive Governors races (Table 17)

![]()

(MIDDLETOWN, CT) November 3, 2016 – As the 2016 general election comes to a close, presidential advertising is down dramatically from 2012 totals, and Hillary Clinton has held a crushing 3 to 1 advertising advantage over Trump in the period June 8 through October 30, 2016. In addition, for the first time ever in real-time, the Wesleyan Media Project is reporting information on local cable airings from NCC Media (which handles about 70 percent of local cable purchases), confirming that Clinton’s air war advantage is even larger than previously reported as Trump did not purchase a single local cable spot from Labor Day through October 30 through NCC Media (he did make a small purchase of just over 25,000 local cable airings over the summer).

![]()

“This ad imbalance is one of the stories of this presidential election,” said Michael Franz, co-director of the Wesleyan Media Project. “Trump remains competitive despite being pummeled in the political ad air war. One might imagine that he would be doing even better, perhaps tipping some of the closer states to his column if his campaign were matching Clinton’s ad for ad. But that presumes ads are effective this campaign in moving opinion of either Trump or Clinton.”

Table 1 makes the comparison of each party’s ad efforts in the presidential election compared to the 2012 campaign. In the general election period in both 2012 and 2016 (defined in both cases as beginning on June 8), Clinton-sponsored ad totals are one-half of those by Obama; Trump-sponsored airings are roughly one-third of Romney’s. Trump falls further behind if ads by supportive groups and the parties are included. The entire pro-Trump effort has sponsored about 100,000 ads since early June. This is in comparison to nearly 500,000 for Mitt Romney in 2012.

![]()

Table 1: Presidential General Election Ad Volumes by Sponsor, 2012 & 2016

Click here for data from last two weeks

| 2012 Pro-Obama | 2016 Pro-Clinton | 2012 Pro-Romney | 2016 Pro-Trump |

||

|---|---|---|---|---|---|

| Cand | 459,622 | 231,241 | 181,924 | 68,805 | |

| Group | 55,897 | 90,032 | 64,335 | 30,636 | |

| Party/Coord | 7,210 | 475 | 242,883 | 0 | |

| Total | 522,729 | 321,748 | 489,142 | 99,441 | |

| Figures are from June 8 to October 30 for each cycle. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||

Clinton Also Dominating on Local Cable Advertising

The Clinton campaign is not only dominating local broadcast and national cable advertising, but also local cable advertising as well. Local cable advertising, which can be aired in smaller geographic areas (zones) than local broadcast ads, are attractive precisely because they can be more targeted, reaching smaller pockets of desirable neighborhoods or citizens more efficiently. According to NCC Media, which provided the Wesleyan Media Project with data on local cable airings, candidate spending on local cable is estimated to be roughly 20 percent of the total candidate presidential spending on advertising in 2016, a lower percentage than predicted in large part because the Trump campaign has been relatively absent on local cable so far.

The Clinton campaign has aired 332,817 ads since Labor Day on local cable, 54 percent more than the Obama campaign had run during the same period in 2012. This increase is in stark comparison to the broadcast totals noted above, where Clinton has put far fewer ads on television than Obama did.

![]()

“We’ve talked a lot this cycle about Clinton’s dominance relative to Trump on local broadcast and national cable air waves, but she has been even more dominant on local cable, airing nearly 330,000 ads to Trump’s zero,” said Erika Franklin Fowler, co-director of the Wesleyan Media Project. “In 2012, Romney actually out-aired Obama on local cable by nearly 44,000 airings for the comparable post-Labor Day period, which makes the Trump campaign’s absence from local cable even more stunning.”

![]()

Table 2: Volume of Presidential Candidate Local Cable Airings, 2012 vs. 2016

| Local Cable Airings | # of Markets | % Increase | ||

|---|---|---|---|---|

| 2012 | Obama | 216,363 | 60 | |

| Romney | 260,210 | 55 | ||

| 2016 | Clinton | 332,817 | 56 | 53.80% |

| Trump | - | 0 | -100.00% | |

| Figures are from 9/3-10/28/12 and 9/5-10/30/16. Numbers include local cable only. CITE SOURCE OF DATA AS: NCC Media with analysis by the Wesleyan Media Project. |

||||

The Clinton campaign has been heavily targeting Orlando (19,467 airings), Philadelphia (18,780 airings), and Las Vegas (18,380 airings) with Boston (16,577 airings) and Greenville/Spartanburg/Asheville (16,285 airings) rounding out the top five target markets and she has been averaging 25 channels deep in many markets throughout the entire general election period targeting a variety of audiences. The Trump campaign purchased a small number of local cable spots over the summer (just over 25,000 airings), but has been absent from air in the post-Labor Day period. As of November 2, the Trump campaign has only booked local cable advertising for Colorado, Michigan and Nevada for the final few days prior to Election Day.

![]()

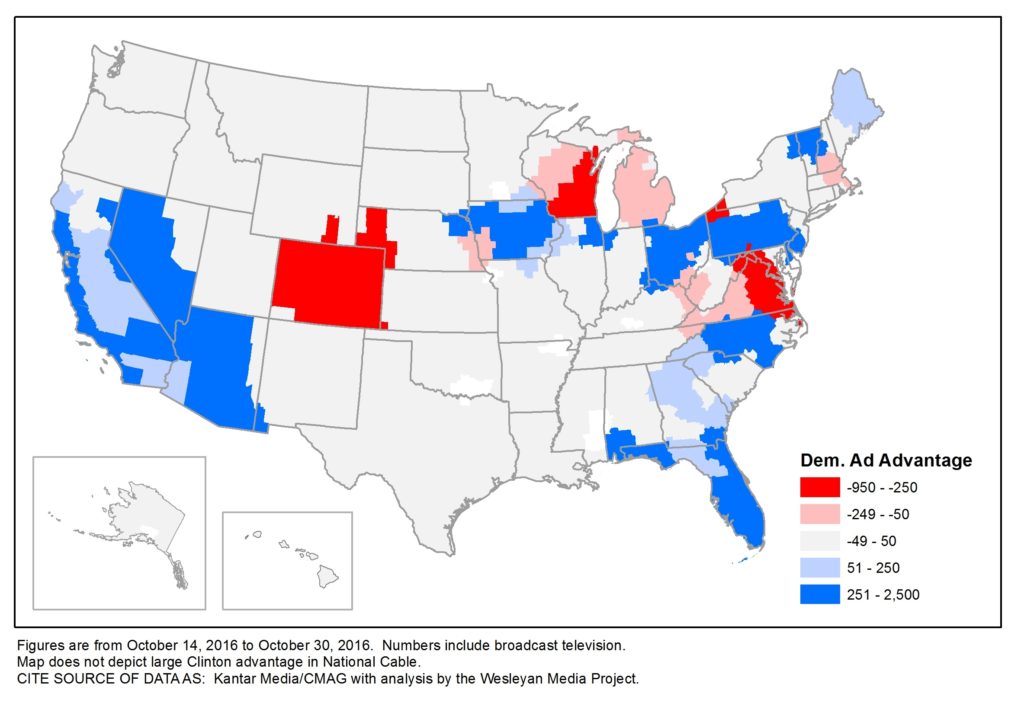

Pro-Clinton Airings Continue to Dominate Top Markets

Advertising by or on behalf of Clinton continued to dominate all of the top 20 media markets by overall volume over the last two weeks of October; the sole exception was Denver, Colorado where Trump had a 709 ad lead. Trump also maintained advantages in Wisconsin, Virginia, Michigan and Erie, Pennsylvania. Pro-Clinton ads also outnumber pro-Trump airings on national cable by 2,620 to 922, a difference of 1,698 airings.

“Instead of focusing all of his advertising in the true battleground states, Trump is advertising in several states that lean toward Clinton. His campaign realizes that they are going to need to win one of those ‘lean Democratic’ states, such as Colorado or Wisconsin, in order to have a path to victory.” said Travis Ridout, co-director of the Wesleyan Media Project.

![]()

Figure 1: Democratic Ad Advantage in Presidential Race (Oct 14-Oct 30 )

Download a csv of the underlying data

![]()

Despite Trump’s recent efforts in some of these battlegrounds, across all top media markets since the beginning of the general election in June, Clinton has aired at least 64 percent of the ads in the top 20 media markets, as shown in Table 3.

![]()

Table 3: Top Media Markets in Presidential Race (General Election)

| Media Market | Dem Ads | Rep Ads | Total Ads | Est Cost (in Millions) | % Dem Ads |

|---|---|---|---|---|---|

| Orlando | 17,710 | 4,386 | 22,096 | 27.7 | 80.2% |

| Tampa | 16,668 | 4,963 | 21,631 | 22.1 | 77.1% |

| Las Vegas | 14,469 | 2,420 | 16,889 | 12.3 | 85.7% |

| Charlotte | 13,155 | 3,282 | 16,437 | 12.8 | 80.0% |

| National Cable | 13,788 | 2,171 | 15,959 | 39.5 | 86.4% |

| West Palm Beach | 11,633 | 3,193 | 14,826 | 8.9 | 78.5% |

| Cleveland | 10,645 | 4,027 | 14,672 | 14.5 | 72.6% |

| Columbus, Ohio | 9,852 | 3,784 | 13,636 | 10.1 | 72.2% |

| Greensboro | 10,289 | 3,064 | 13,353 | 4.7 | 77.1% |

| Raleigh | 9,887 | 2,892 | 12,779 | 8.4 | 77.4% |

| Philadelphia | 9,804 | 2,679 | 12,483 | 13.4 | 78.5% |

| Reno | 9,881 | 2,467 | 12,348 | 5.8 | 80.0% |

| Cincinnati | 8,529 | 3,265 | 11,794 | 6.0 | 72.3% |

| Jacksonville | 8,489 | 2,884 | 11,373 | 4.1 | 74.6% |

| Pittsburgh | 7,463 | 2,935 | 10,398 | 9.0 | 71.8% |

| Dayton | 7,983 | 2,060 | 10,043 | 4.8 | 79.5% |

| Des Moines | 8,701 | 941 | 9,642 | 4.6 | 90.2% |

| Denver | 6,037 | 3,292 | 9,329 | 8.5 | 64.7% |

| Toledo | 7,532 | 1,719 | 9,251 | 4.1 | 81.4% |

| Harrisburg | 6,455 | 2,724 | 9,179 | 4.5 | 70.3% |

| Cedar Rapids | 7,621 | 1,090 | 8,711 | 3.4 | 87.5% |

| Ft. Myers | 7,261 | 1,295 | 8,556 | 3.1 | 84.9% |

| Figures are from June 8, 2016 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||

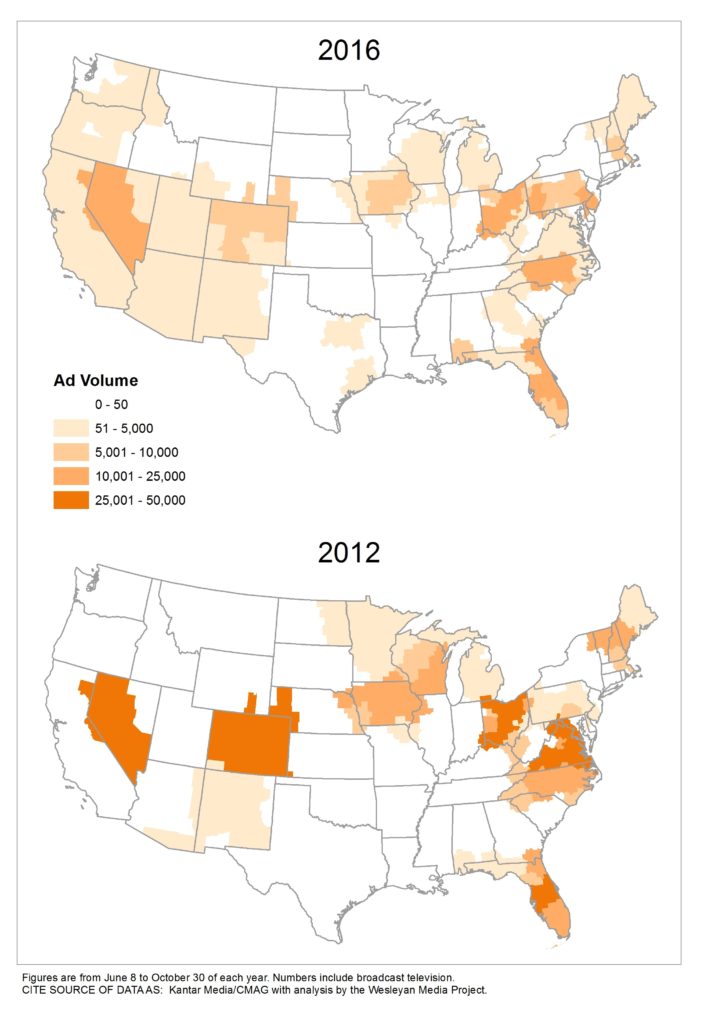

Figure 2 looks at the ad volumes in the general election periods of the 2012 and 2016 presidential races. Top markets from 2012 have seen declines in presidential advertising this cycle. For example, Denver, Las Vegas, Cleveland, and Tampa have all seen fewer ads in 2016. At the same time, the spread of states with at least modest levels of ad buys has expanded. Only about 16 states have seen minimal advertising (fewer than 50 presidential ads) on broadcast television in 2016.

![]()

Figure 2: Presidential Ad Volumes in 2016 and 2012

![]()

Sanders’ Ad Volume Still Tops Donald Trump’s Cycle-to-Date

Table 4 outlines the top advertisers in the presidential election since the beginning of the cycle in 2015. Hillary Clinton tops the list, having spent over $219 million on television ads. Her primary election opponent, Bernie Sanders, remains in the second spot, having spent over $75 million in his bid to be the Democratic nominee. Interestingly, ads sponsored by Sanders still outnumber ads sponsored by Trump (128,000 to 101,000), even when including Trump’s primary election ad buys.

![]()

Table 4: Top Advertisers in the Presidential Campaign

| Sponsor | Ads | Est. Cost (in Millions) |

|---|---|---|

| Clinton, Hillary | 340,745 | 219.3 |

| Sanders, Bernie | 128,494 | 76 |

| Trump, Donald | 101,849 | 76.6 |

| Priorities USA Action | 76,965 | 75.3 |

| Right To Rise USA | 35,558 | 62.2 |

| Cruz, Ted | 30,262 | 16.8 |

| Conservative Solutions PAC | 30,169 | 50.9 |

| Rubio, Marco | 24,076 | 14.2 |

| Carson, Ben | 12,119 | 4.3 |

| Rebuilding America Now PAC | 11,107 | 10.2 |

| NextGen California Action Committee | 10,437 | 11.4 |

| Stand For Truth, Inc | 10,330 | 9.2 |

| NRA Institute For Legislative Action | 9,236 | 9.4 |

| Kasich, John | 8,297 | 3.5 |

| Our Principles PAC | 7,000 | 8.4 |

| Figures are from January 1, 2015, to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

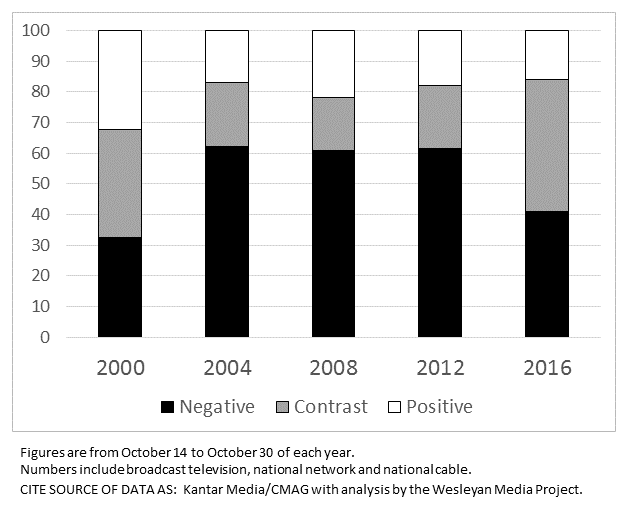

2016 Presidential General Election More Positive Than 2012

Figure 3 shows trends in negativity for general election presidential advertising (defined as June 8 through Oct 30 of each year). Despite the ugly nature of the 2016 cycle, the tone of political advertising is considerably more positive than the 2012 campaign. Still, over 50 percent of presidential ads this cycle have been negative, and 25 percent have been contrast ads—ads that both promote the sponsor and attack the opponent.

“There are many possible reasons for the slight decline in advertising negativity this cycle,” said Travis Ridout, co-director of the Wesleyan Media Project. “But I think that the bruising nature of the news and the high unfavorable ratings for both candidates have led the campaigns to pursue slightly more positive tactics in advertising than they otherwise might have done.”

![]()

Figure 3: Tone of Presidential General Election Advertising

See this in a table

Click here for data from last two weeks

![]()

In the last two weeks since our last release (Oct 14-Oct 30), pure attacks in presidential advertising comprised just 41 percent of airings, which is substantially lower than the last three presidential cycles, all of which saw more than 60 percent pure attack ads for the same period. Contrast ads, though, have been much more common during the past few weeks than in any of the previous four presidential cycles (43 percent compared to 35 percent in 2000, 21 percent for 2004 and 2012 and 17 percent in 2008).

Clinton More, Trump Less Likely to Feature Opponent’s Voice in Closing Weeks

As shown in Table 5, over 3 out of every 4 Clinton-sponsored pure attack ads have featured Trump’s voice. Trump’s attacks have featured Clinton’s voice less often in just under half of all airings during the traditional general election period (from Labor Day through October 30). In the final weeks, the two campaigns are taking different tactics with the Clinton campaign solely airing attack ads featuring Trump’s voice and the Trump campaign only featuring Clinton in one out of every 10 negative spots.

![]()

Table 5: Opponent’s Voice in Presidential Candidate-Sponsored Attacks

| % of Trump | % of Clinton | ||

|---|---|---|---|

| Opponent's voice | 9/5-10/30 | 46.4% | 76.9% |

| 10/14-10/30 | 10.2% | 100.0% | |

| Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||

Groups, Candidates Differ on Top Issues

Presidential ads over the last two weeks have varied in their issue focus depending upon the sponsor. While Clinton has been emphasizing women’s rights, Iraq, education, public safety and jobs; outside groups working on her behalf (largely Priorities USA Action) have hit immigration, followed by education, minority rights and public safety. Trump has focused on taxes, terrorism, jobs/unemployment and Benghazi. His supporting groups have focused on gun control (given the NRA’s heavy involvement), followed by the Supreme Court, Benghazi, abortion and corruption.

![]()

Table 6: Top Issues in Presidential Race by Sponsor

| Clinton | Pro-Clinton Groups | Trump | Pro-Trump Groups |

|---|---|---|---|

| Women's Rights | Immigration | Taxes | Gun Control |

| Iraq | Education | Terrorism | Supreme Court |

| Education | LGBTQ Rights | Jobs | Benghazi |

| Public Safety | Women's Rights | Unemployment | Abortion |

| Jobs | Public Safety | Benghazi | Corruption |

| Figures are from October 14, 2016 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||

3.3M Airings in 2016 Cycle; Estimated $2.4B Spent

The total cost for ads aired cycle-to-date on broadcast stations across the country has passed $2.3 billion for races up and down the ballot. In the presidential election, including the primary and general election phases of the campaign, candidates and supportive organizations have aired over 900,000 ads costing over $750 million. Senate spending is double that of ads for House races, coming in at just under $600 million. Over $400 million has been spent on 350,000 ads advocating for or against ballot measures across the country. These totals are shown in Table 7.

![]()

Table 7: Ad Spending in 2016 Cycle

| Race | Est Cost (in Millions) | Ads |

|---|---|---|

| President | 760.9 | 920,070 |

| Senate | 593.3 | 790,226 |

| House | 276.6 | 507,983 |

| Ballot Measures | 406.0 | 354,306 |

| Governor | 155.0 | 417,437 |

| All other races | 159.6 | 340,954 |

| Total | 2,351.5 | 3,330,976 |

| Figures are from January 1, 2015, to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

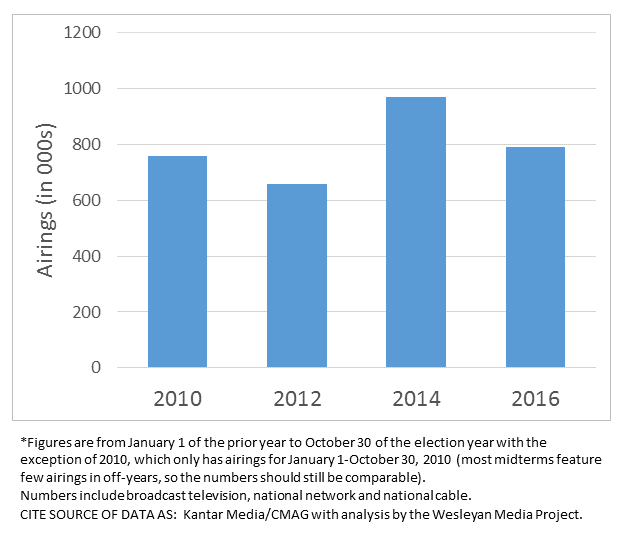

2016 Senate ads match 2010 totals; Comparable in tone to last three cycles

The volume of Senate ad airings is up slightly (4 percent) compared to the last time these particular seats were contested in 2010, and up 20 percent over 2012 Senate contests. Ad totals are down nearly 19 percent from 2014 Senate totals. These totals count ads from January 1 of the prior year to October 30 of the election year.*

![]()

Figure 4: Volume of Senate Advertising by Cycle

![]()

As shown in Figure 5, unlike the anomalous 2016 presidential race, the tone of senatorial advertising in 2016 has been very consistent with prior cycles. Rates of negativity in all four cycles hover at around 50 percent pure attack and nearly 75 percent attack and contrast. Through October 30, the 2016 cycle ranks second in negativity, with 53 percent pure attack (compared to 54 percent in 2012) and 73 percent attack and contrast (compared to 75 percent in 2012).

![]()

Figure 5: Tone of Senatorial General Election Advertising

![]()

Senate Advertising Features

Presidential Candidates

References to presidential candidates and President Obama in Senate advertising vary by party. Pro-Republican airings have negatively referenced Clinton slightly more often than Obama (nearly 14 compared to just over 12 percent) while pro-Democratic airings have negatively referenced Trump less often in just over 4 percent of all airings. In comparison, in 2008 (the last presidential election without an incumbent running), pro-Republican senate ads negatively referenced Obama in 4 percent of all airings and zero percent of pro-Democratic airings negatively referenced McCain.

Ads by or on behalf of Democratic senatorial candidates have also taken a page from Clinton’s playbook by featuring Trump’s voice in nearly 4 percent of their airings and a direct Trump quote (in text on screen or spoken by someone else) in just over 1 percent of airings.

![]()

Table 8: References in Senate Ads (Sept 5 – Oct 30)

| Pro-Dem | Pro-Rep | |

|---|---|---|

| Neg Obama Mention | 0.0% | 12.4% |

| Neg Clinton Mention | 0% | 13.7% |

| Clinton Voice | 0% | 1% |

| Clinton Quote | 0% | 0% |

| Neg Trump Mention | 4% | 0% |

| Trump Voice | 4% | 0% |

| Trump Quote | 1% | 0% |

| Figures are from Sept 5, 2016 - Oct 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

The Wesleyan Media Project also coded for specific words that appeared in Senate advertising in the period from Labor Day through October 30. Ads by or on behalf of Democratic Senate candidates were most likely to mention special interests (10 percent of airings) followed by Wall Street (10 percent) and Planned Parenthood (5.5 percent). Pro-Republican airings by contrast were most likely to mention liberal (nearly 13 percent of airings), followed by Obamacare (nearly 11 percent) and Wall Street (nearly 6 percent).

![]()

Table 9: Word Mentions by Party in Senate Ads (Sept 5 – Oct 30)

| Pro-Dem | Pro-Rep | |

|---|---|---|

| Change | 4% | 0% |

| Liberal | 0% | 13% |

| Conservative | 1% | 4% |

| Special Interests | 10% | 4% |

| Dirty/Negative Campaigner | 0% | 1% |

| Working Class | 2% | 1% |

| Middle Class | 5% | 2% |

| Upper Class/Rich/Wealthy | 1% | 1% |

| Wall Street | 10% | 5% |

| Big Gov't | 0% | 2% |

| Obamacare | 1% | 11% |

| Planned Parenthood | 6% | 0% |

| Out-of-State Money | 0% | 1% |

| Millionaire/Billionaire | 1% | 0% |

| Rigged | 1% | 1% |

| Figures are from Sept 5, 2016 - Oct 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

PA race tops Senate airings; over $100 million in ads alone

The top Senate race for ads aired this cycle is Pennsylvania, with over $100 million spent on ads cycle-to-date. New Hampshire is ninth on the list in terms of ads aired, but second in terms of cost, with over $90 million in ads for the race between Democrat Maggie Hassan and incumbent Republican Kelly Ayotte (includes primary election spending). Eight Senate races have seen at least $30 million in spending on broadcast ads. Spending on ads in all Senate races this cycle is outlined in Table 10.

![]()

Table 10: Top US Senate Races Cycle-to-Date

| State | Airings | Est. Cost (in Ms) |

|---|---|---|

| PA | 111,405 | 102.3 |

| OH | 78,074 | 56.8 |

| IN | 75,847 | 38.2 |

| NV | 68,860 | 45.6 |

| WI | 58,784 | 30.6 |

| FL | 56,713 | 45.3 |

| MO | 55,108 | 33.4 |

| NC | 53,624 | 26.7 |

| NH | 48,166 | 93.4 |

| IL | 24,313 | 23.2 |

| AZ | 20,023 | 14.3 |

| CO | 18,856 | 12.0 |

| LA | 17,782 | 8.5 |

| GA | 13,903 | 6.9 |

| MD | 12,732 | 13.7 |

| CA | 11,888 | 11.9 |

| AL | 11,412 | 6.8 |

| KY | 10,177 | 3.7 |

| IA | 8,886 | 4.0 |

| AR | 5,735 | 2.0 |

| NY | 5,076 | 4.2 |

| ID | 4,046 | 0.7 |

| OR | 3,760 | 2.0 |

| WA | 3,436 | 2.7 |

| KS | 2,505 | 0.9 |

| CT | 2,233 | 1.5 |

| AK | 2,157 | 0.5 |

| ND | 1,529 | 0.4 |

| SC | 1,447 | 0.4 |

| VT | 683 | 0.2 |

| HI | 545 | 0.2 |

| UT | 269 | 0.1 |

| OK | 252 | 0.1 |

| Figures are from January 1, 2015 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

Table 11 looks at spending in Senate races since our last release, covering the October 14 to October 30 period. North Carolina has seen the most ads in these two weeks, with over 26,000 ads. Democratic and Republican outside groups are clearly invested in Senate races; many have aired more ads than the candidates they support. For example, pro-Democratic groups have aired more ads than the candidate in North Carolina, Pennsylvania, Missouri, Nevada, and New Hampshire. The same is true on the Republican side for Pennsylvania, Indiana, Missouri, Nevada, and New Hampshire.

![]()

Table 11: Ad Volume and Spending in US Senate Races (Oct 14-Oct 30 )

Click here for data since Labor Day

| State | Airings | Est. Cost (in Ms) | Dem Adv. | Dem Cand | Pro-Dem Party/ Coord | Pro-Dem Grp | Rep Cand | Pro-Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| NC | 26,836 | 11.1 | 10,034 | 4,910 | 8,543 | 4,982 | 4,842 | 328 | 3,231 |

| PA | 21,096 | 15.0 | 4,778 | 4,306 | 3,468 | 5,163 | 3,828 | 200 | 4,131 |

| IN | 19,741 | 10.6 | 3,543 | 4,587 | 2,957 | 4,098 | 2,691 | 1,469 | 3,939 |

| MO | 19,189 | 10.6 | 2,341 | 2,477 | 4,338 | 3,950 | 3,644 | 770 | 4,010 |

| NV | 13,673 | 9.0 | 2,459 | 1,827 | 2,803 | 3,436 | 1,298 | 555 | 3,754 |

| FL | 12,909 | 7.3 | -6,343 | 2,967 | 0 | 316 | 6,379 | 0 | 3,247 |

| WI | 12,060 | 5.1 | 932 | 3,654 | 2,380 | 462 | 3,198 | 0 | 2,366 |

| NH | 11,271 | 19.5 | 3,155 | 1,991 | 3,005 | 2,217 | 1,896 | 40 | 2,122 |

| LA | 7,614 | 3.7 | -3,626 | 1,957 | 0 | 37 | 4,178 | 0 | 1,442 |

| IL | 4,813 | 3.8 | 2,299 | 3,556 | 0 | 0 | 214 | 420 | 623 |

| OH | 4,805 | 2.6 | -3,261 | 772 | 0 | 0 | 3,791 | 0 | 242 |

| KY | 3,807 | 1.3 | 799 | 1,916 | 0 | 387 | 933 | 302 | 269 |

| NY | 3,429 | 3.6 | 3,429 | 3,429 | 0 | 0 | 0 | 0 | 0 |

| GA | 3,320 | 1.6 | -3,320 | 0 | 0 | 0 | 2,914 | 0 | 406 |

| AZ | 3,098 | 1.5 | -754 | 1,172 | 0 | 0 | 1,926 | 0 | 0 |

| CO | 2,527 | 1.1 | -65 | 1,231 | 0 | 0 | 987 | 0 | 309 |

| IA | 2,038 | 0.5 | -2,030 | 4 | 0 | 0 | 2,034 | 0 | 0 |

| CA | 2,035 | 3.1 | 2,035 | 1,361 | 0 | 674 | 0 | 0 | 0 |

| AR | 1,984 | 0.6 | -464 | 760 | 0 | 0 | 1,224 | 0 | 0 |

| OR | 1,893 | 1.0 | 1,893 | 1,893 | 0 | 0 | 0 | 0 | 0 |

| ID | 1,824 | 0.3 | -1,820 | 2 | 0 | 0 | 1,822 | 0 | 0 |

| WA | 1,770 | 1.3 | 1,770 | 1,770 | 0 | 0 | 0 | 0 | 0 |

| SC | 1,447 | 0.4 | -1,447 | 0 | 0 | 0 | 1,447 | 0 | 0 |

| KS | 1,189 | 0.3 | -1,189 | 0 | 0 | 0 | 1,189 | 0 | 0 |

| CT | 892 | 0.5 | 892 | 892 | 0 | 0 | 0 | 0 | 0 |

| MD | 755 | 0.5 | 755 | 755 | 0 | 0 | 0 | 0 | 0 |

| ND | 570 | 0.1 | -570 | 0 | 0 | 0 | 570 | 0 | 0 |

| AK | 494 | 0.1 | -494 | 0 | 0 | 0 | 494 | 0 | 0 |

| HI | 337 | 0.1 | 337 | 337 | 0 | 0 | 0 | 0 | 0 |

| UT | 269 | 0.1 | -269 | 0 | 0 | 0 | 269 | 0 | 0 |

| OK | 252 | 0.1 | -252 | 0 | 0 | 0 | 252 | 0 | 0 |

| VT | 251 | 0.04 | 251 | 251 | 0 | 0 | 0 | 0 | 0 |

| Figures are from October 14, 2016 to October 30, 2016. Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. *Two Democrats are competing against each other in California’s Senate general election. |

|||||||||

North Carolina tops the list of least positive US Senate races, with just 8 percent of ads being positive. Nevada ranks second with 11 percent of ads purely positive and the highest number of pure attack ads (79 percent). Indiana is the third least positive at 14 percent.

![]()

Table 12: Least Positive Senate Races (Sept 1 – Oct 30)

| State | Airings | Neg% | Con% | Pos% |

|---|---|---|---|---|

| NC | 51,130 | 65% | 27% | 8% |

| NV | 42,406 | 79% | 10% | 11% |

| IN | 50,349 | 73% | 13% | 14% |

| PA | 58,987 | 63% | 21% | 16% |

| FL | 35,094 | 62% | 22% | 16% |

| MO | 45,837 | 65% | 17% | 18% |

| NH | 30,476 | 69% | 10% | 21% |

| IL | 13,098 | 28% | 48% | 24% |

| AZ | 11,211 | 26% | 49% | 25% |

| WI | 28,016 | 48% | 24% | 27% |

| OH | 19,374 | 40% | 15% | 45% |

| GA | 8,325 | 0% | 53% | 47% |

| AR | 5,104 | 8% | 42% | 49% |

| KY | 8,191 | 30% | 18% | 52% |

| LA | 17,084 | 15% | 23% | 62% |

| IA | 5,626 | 2% | 35% | 63% |

| CO | 4,899 | 0% | 28% | 72% |

| AK | 1,184 | 0% | 3% | 97% |

| Figures are from September 1 to October 30, 2016 and may include some primary advertising activity. All other senate contest have 100 percent positive promotional spots. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||||

Maine Tops the List for House races

The second district of Maine is one of the most competitive House races this cycle, and it tops the list for ad buys with over 21,000 ads costing $7 million cycle-to-date. Top ad totals in House races are outlined in Table 13. The differential cost of ads across media markets is apparent in the table, with MN-8 seeing about 6,000 fewer ads than ME-2, but those ads have cost about $5.5 million more.

![]()

Table 13: Top US House Races Cycle-to-Date

| District | Airings | Est. Cost (in Ms) |

|---|---|---|

| ME02 | 21,786 | 7.1 |

| CA24 | 19,696 | 3.0 |

| NY22 | 19,544 | 3.7 |

| MT01 | 18,451 | 1.9 |

| FL18 | 15,917 | 7.7 |

| MN08 | 15,104 | 12.7 |

| NY24 | 12,441 | 3.0 |

| TX23 | 11,678 | 8.4 |

| IA01 | 10,869 | 3.6 |

| NY19 | 10,784 | 3.9 |

| NE02 | 10,677 | 4.1 |

| IA03 | 10,448 | 4.0 |

| NV03 | 9,686 | 8.1 |

| NV04 | 9,678 | 6.9 |

| WI08 | 9,365 | 2.8 |

| KS01 | 9,201 | 2.9 |

| IN09 | 9,161 | 5.3 |

| AZ02 | 8,296 | 2.9 |

| CO06 | 8,235 | 6.9 |

| CA49 | 7,912 | 3.6 |

| PA08 | 7,293 | 8.8 |

| CA21 | 7,273 | 2.3 |

| MI07 | 7,059 | 2.1 |

| FL19 | 7,009 | 3.1 |

| MN02 | 6,783 | 5.9 |

| MN03 | 6,645 | 5.4 |

| FL26 | 6,591 | 6.7 |

| TN08 | 6,501 | 2.9 |

| MD08 | 6,250 | 13.1 |

| CA07 | 6,138 | 3.8 |

| IL10 | 6,093 | 12.6 |

| VA10 | 6,039 | 11.3 |

| Figures are from January 1, 2015 to October 30, 2016. Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||

Maine’s 2nd district has also seen the most airings with nearly 8,500 ads in the last two weeks alone. Democratic challenger Emily Cain held a 786 ad airing advantage (thanks to outside group and party/coordinated airings) over incumbent Republican Bruce Poliquin. Montana’s first district (6,628 airings) and Texas’ 23rd district (5,798 airings) rounded out the top three.

![]()

Table 14: Ad Volume and Spending in Top US House Races (Oct 14-Oct 30)

Click here for data since Labor Day

| District | Airings | Est. Cost (in Ms) | Dem Adv. | Dem Cand | Pro-Dem Party/ Coord | Pro-Dem Grp | Rep Cand | Pro-Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| ME02 | 8,492 | 2.7 | 786 | 1,197 | 1,791 | 1,651 | 1,800 | 1,468 | 585 |

| MT01 | 6,628 | 0.7 | 712 | 3,357 | 0 | 313 | 2,958 | 0 | 0 |

| TX23 | 5,798 | 4.4 | 1,474 | 555 | 2,150 | 931 | 713 | 954 | 495 |

| MN08 | 4,819 | 4.7 | 1,351 | 804 | 1,814 | 467 | 490 | 63 | 1,181 |

| FL18 | 4,761 | 2.5 | 117 | 2,439 | 0 | 0 | 242 | 1,144 | 936 |

| NY19 | 4,750 | 1.7 | -486 | 897 | 1,235 | 0 | 641 | 1,261 | 716 |

| CA49 | 4,393 | 2.2 | 1,389 | 0 | 2,468 | 423 | 1,502 | 0 | 0 |

| NY22 | 4,389 | 0.9 | 1,643 | 540 | 964 | 1,512 | 282 | 1,091 | 0 |

| NY24 | 4,325 | 1.1 | 177 | 0 | 1,879 | 372 | 744 | 548 | 782 |

| CA21 | 4,222 | 1.5 | -148 | 0 | 0 | 2,037 | 1,869 | 0 | 316 |

| CO06 | 3,877 | 3 | 425 | 272 | 1,666 | 213 | 444 | 1,147 | 135 |

| IA03 | 3,826 | 1.5 | -294 | 137 | 1,629 | 0 | 487 | 614 | 959 |

| IN09 | 3,807 | 2.1 | -395 | 852 | 18 | 836 | 1,281 | 730 | 90 |

| CA10 | 3,740 | 2.5 | 644 | 106 | 2,086 | 0 | 858 | 0 | 690 |

| NV03 | 3,582 | 3.3 | -224 | 175 | 722 | 782 | 0 | 528 | 1,375 |

| VA10 | 3,540 | 6.8 | 590 | 0 | 995 | 1,070 | 361 | 356 | 758 |

| IA01 | 3,516 | 1.1 | 402 | 686 | 874 | 399 | 647 | 659 | 251 |

| FL26 | 3,476 | 3.5 | -156 | 283 | 846 | 531 | 255 | 906 | 655 |

| NE02 | 3,270 | 1.3 | 40 | 843 | 577 | 235 | 452 | 801 | 362 |

| CA24 | 3,165 | 0.5 | 79 | 1,238 | 0 | 384 | 821 | 722 | 0 |

| CA07 | 2,962 | 2.1 | -16 | 316 | 913 | 244 | 82 | 1,116 | 291 |

| IL10 | 2,908 | 5.7 | 284 | 0 | 1,182 | 414 | 659 | 653 | 0 |

| MN02 | 2,885 | 2.4 | 899 | 799 | 901 | 192 | 4 | 989 | 0 |

| CO03 | 2,863 | 1.5 | -823 | 541 | 0 | 479 | 1,118 | 0 | 725 |

| ME02 | 8,492 | 2.7 | 786 | 1,197 | 1,791 | 1,651 | 1,800 | 1,468 | 585 |

| MT01 | 6,628 | 0.7 | 712 | 3,357 | 0 | 313 | 2,958 | 0 | 0 |

| TX23 | 5,798 | 4.4 | 1,474 | 555 | 2,150 | 931 | 713 | 954 | 495 |

| MN08 | 4,819 | 4.7 | 1,351 | 804 | 1,814 | 467 | 490 | 63 | 1,181 |

| FL18 | 4,761 | 2.5 | 117 | 2,439 | 0 | 0 | 242 | 1,144 | 936 |

| NY19 | 4,750 | 1.7 | -486 | 897 | 1,235 | 0 | 641 | 1,261 | 716 |

| CA49 | 4,393 | 2.2 | 1,389 | 0 | 2,468 | 423 | 1,502 | 0 | 0 |

| Figures are from October 14, 2016 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||||||

The open race for Michigan’s 1st district between Republican Jack Bergman and Democrat Lon Johnson earns the distinction as the least positive and most negative US House race in the country. It has only seen 315 total airings on local broadcast, but every single one has been an attack ad. New Jersey’s 5th, Colorado’s 3rd district and California’s 25th district have all also seen zero positive ads, but have had a mix of negative and contrast.

![]()

Table 15: Least Positive US House Races* (Sept 1 – Oct 30)

| District | Airings | Neg % | Con % | Pos % |

|---|---|---|---|---|

| MI01 | 315 | 100.0% | 0.0% | 0.0% |

| NJ05 | 950 | 62.6% | 37.4% | 0.0% |

| CO03 | 5,347 | 54.1% | 45.9% | 0.0% |

| CA25 | 726 | 34.4% | 65.6% | 0.0% |

| AK01 | 3,335 | 48.5% | 47.4% | 4.1% |

| MI07 | 6,834 | 30.1% | 63.3% | 6.7% |

| CA10 | 5,141 | 27.5% | 65.3% | 7.2% |

| NV04 | 7,055 | 60.0% | 32.0% | 8.0% |

| CA49 | 7,912 | 42.5% | 47.7% | 9.8% |

| MN03 | 6,645 | 73.6% | 14.6% | 11.7% |

| VA10 | 5,854 | 56.0% | 32.1% | 11.8% |

| CA24 | 8,781 | 56.0% | 31.9% | 12.2% |

| FL26 | 6,493 | 76.9% | 10.6% | 12.5% |

| PA16 | 1,589 | 23.1% | 63.4% | 13.5% |

| PA08 | 6,382 | 65.0% | 21.4% | 13.6% |

| KS03 | 3,340 | 58.2% | 27.5% | 14.3% |

| MN08 | 12,529 | 73.2% | 11.6% | 15.3% |

| ME02 | 19,950 | 66.3% | 17.9% | 15.8% |

| NV03 | 8,119 | 59.0% | 25.0% | 16.0% |

| CO06 | 8,133 | 71.2% | 12.7% | 16.1% |

| *Excludes races with fewer than 300 total airings. Figures are from September 1 to October 30, 2016 and may include some primary advertising activity. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||||

NC Tops the List of Gubernatorial Races by Volume; WV is Least Positive

North Carolina’s contest between incumbent Republican governor Pat McCrory and Democrat Roy Cooper tops the list of governors races by total ad volume since our last release with over 13,500 airings. Missouri, Indiana and Montana round out the next three, all with over 11,000 airings from the last two weeks alone.

![]()

Table 16: Ad Volume and Spending in Top Governor Races (Oct 14-Oct 30)

Click here for data since Labor Day

| State | Airings | Est. Cost (in Ms) | Dem Adv. | Dem Cand | Pro-Dem Party/ Coord | Pro-Dem Grp | Rep Cand | Pro-Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| NC | 13,525 | 5.5 | 4,407 | 6,778 | 0 | 2,188 | 2,594 | 1,954 | 11 |

| MO | 12,977 | 4.7 | -1,145 | 5,916 | 0 | 0 | 6,975 | 0 | 86 |

| IN | 11,670 | 5 | -188 | 5,329 | 0 | 412 | 5,929 | 0 | 0 |

| MT | 11,222 | 1.4 | -1,982 | 2,274 | 0 | 2,346 | 6,602 | 0 | 0 |

| WV | 4,148 | 0.7 | 372 | 2,260 | 0 | 0 | 966 | 922 | 0 |

| WA | 3,785 | 3.5 | 2,827 | 2,052 | 0 | 1,254 | 479 | 0 | 0 |

| VT | 3,097 | 1.4 | -545 | 554 | 0 | 722 | 613 | 0 | 1,208 |

| OR | 3,095 | 1.1 | 1,327 | 2,211 | 0 | 0 | 884 | 0 | 0 |

| NH | 2,111 | 3.6 | 917 | 215 | 636 | 663 | 306 | 0 | 291 |

| ND | 760 | 0.2 | -760 | 0 | 0 | 0 | 760 | 0 | 0 |

| UT | 318 | 0.2 | 46 | 182 | 0 | 0 | 136 | 0 | 0 |

| Figures are from October 14, 2016 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||||||

West Virginia’s gubernatorial race between Democrat Jim Justice and Republican Bill Cole to replace the term-limited incumbent Earl Ray Tomblin is the least positive 2016 gubernatorial contest (16 percent positive) and also earns the distinction for having the highest proportion of pure attacks (81 percent). North Carolina’s ranks second with just under two in every 10 ads (19 percent) being positive. Montana’s gubernatorial contest rounds out the top three least positive races.

![]()

Table 17: Least Positive Governor Races (Sept 1 – Oct 30)

| State | Airings | Neg % | Con % | Pos % |

|---|---|---|---|---|

| WV | 8,489 | 80.9% | 3.6% | 15.5% |

| NC | 37,347 | 59.0% | 21.8% | 19.2% |

| MT | 38,146 | 55.8% | 13.0% | 31.2% |

| MO | 34,753 | 44.7% | 22.9% | 32.3% |

| NH | 4,498 | 43.5% | 16.0% | 40.5% |

| IN | 24,531 | 42.9% | 23.9% | 33.2% |

| WA | 5,066 | 36.5% | 1.2% | 62.2% |

| VT | 6,935 | 35.0% | 16.0% | 49.0% |

| OR | 6,793 | 17.5% | 2.1% | 80.3% |

| UT | 667 | 6.0% | 0.0% | 94.0% |

| ND | 924 | 0.0% | 0.0% | 100.0% |

| Figures are from September 1 to October 30 of each year and may include some primary advertising activity. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

||||

Most Active Groups

An analysis of group activity this election cycle, done in conjunction with the Center for Responsive Politics, reveals a range of groups involved in federal elections this cycle. Most of the groups in Table 18 are super PACs, including the top seven outside groups.

Priorities USA is the top outside group this cycle, having sponsored over 77,000 ads, almost all of them in support of Hillary Clinton. Right to Rise, the pro-Jeb Bush super PAC, is still in the top 5 of outside group efforts this cycle, despite being off the air for over 6 months.

Most of the congressional activity is on the Senate side, with 7 groups sponsoring at least 10,000 ads for or against candidates. Senate Majority PAC is the top group in this set of races, with over 44,000 ads.

On the House side, House Majority PAC has sponsored nearly 29,000 ads for Democratic candidates. This means that across the presidential, Senate, and House races, the top group in each is a pro-Democratic one.

Only a handful of groups are active in multiple settings, for example the Club for Growth (6,500 ads in the presidential race and 2,400 in the Senate), the NRA, and American Future Fund. Most groups spend the bulk of their ads in either the presidential race or congressional races.

![]()

“Over the last six years, outside groups have evolved to become more specialized,” said Sheila Krumholz, executive director of the Center for Responsive Politics. “In the early days after Citizens United, groups were formed and spent heavily in races up and down the ballot, but increasingly we see spending from groups that specialize in a certain kind of race, or solely target a specific candidate, even.”

![]()

Table 18: Top Group Advertisers in 2015-16 Election Cycle

| Group | Total Ads | Pres Ads | Sen Ads | House Ads | Disclose? | Org. Type |

|---|---|---|---|---|---|---|

| Priorities USA Action | 77,701 | 76,965 | 676 | 60 | Y | super PAC |

| Senate Majority PAC | 44,069 | 0 | 44,069 | 0 | Y | super PAC |

| Senate Leadership Fund | 37,002 | 0 | 37,002 | 0 | P | super PAC |

| Right to Rise USA | 35,558 | 35,558 | 0 | 0 | Y | super PAC |

| Conservative Solutions PAC | 30,169 | 30,169 | 0 | 0 | Y | super PAC |

| House Majority PAC | 28,889 | 0 | 0 | 28,889 | Y | super PAC |

| Freedom Partners Action Fund | 25,243 | 0 | 25,243 | 0 | Y | super PAC |

| One Nation | 20,216 | 0 | 20,216 | 0 | N | c4 |

| US Chamber of Commerce | 18,374 | 0 | 16,181 | 2,193 | N | c6 |

| Congressional Leadership Fund | 14,091 | 0 | 0 | 14,091 | P | super PAC |

| Club for Growth | 14,069 | 6,548 | 2,431 | 5,090 | Y | super PAC |

| NRA Institute for Legislative Action | 13,126 | 9,236 | 3,890 | 0 | N | c4 |

| Fighting for Ohio Fund | 13,074 | 0 | 13,074 | 0 | Y | super PAC |

| Women Vote | 12,194 | 1,305 | 10,361 | 528 | P | super PAC |

| Rebuilding America Now PAC | 11,107 | 11,107 | 0 | 0 | Y | super PAC |

| NextGen California Action Cmte | 10,437 | 10,437 | 0 | 0 | Y | super PAC |

| Stand for Truth | 10,330 | 10,330 | 0 | 0 | Y | super PAC |

| AFSCME People | 9,621 | 0 | 9,621 | 0 | Y | PAC |

| American Future Fund | 9,049 | 5,293 | 3,756 | 0 | N | c4 |

| End Citizens United | 8,727 | 0 | 7,265 | 1,462 | Y | PAC |

| NRA Political Victory Fund | 7,246 | 4,618 | 2,628 | 0 | Y | PAC |

| Granite State Solutions | 7,039 | 0 | 7,039 | 0 | Y | super PAC |

| Our Principles PAC | 7,000 | 7,000 | 0 | 0 | Y | super PAC |

| Vote Vets Action Fund | 6,217 | 0 | 5,227 | 990 | N | c4 |

| Majority Forward | 6,051 | 0 | 6,051 | 0 | N | 501c4 |

| AFSCME | 5,886 | 0 | 5,886 | 0 | Y | c5 |

| Americans for Prosperity | 5,427 | 0 | 5,427 | 0 | N | c4 |

| New Day for America | 5,394 | 5,394 | 0 | 0 | Y | super PAC |

| America Leads | 5,377 | 5,377 | 0 | 0 | Y | super PAC |

| Independence USA PAC | 5,288 | 0 | 4,893 | 395 | Y | super PAC |

| ESA Fund | 5,097 | 410 | 2,029 | 2,658 | Y | super PAC |

| Group classification by the Center for Responsive Politics. Figures are from January 1, 2015 to October 30, 2016. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. In the Disclosure column, a Y indicates the group full discloses its donors, a P indicates partial disclosure, while N indicates no disclosure of donors. |

||||||

Download a PDF of this report here

![]()

![]()

About This Report

Data reported here do not cover local cable buys, only broadcast television, national network and national cable buys. We include all ads that mention individuals running for office, and therefore sums may include issue advocacy advertising. All cost estimates are precisely that: estimates. Disclosure categorization information on outside groups comes from the Center for Responsive Politics.

The Wesleyan Media Project provides real-time tracking and analysis of all political television advertising in an effort to increase transparency in elections. Housed in Wesleyan’s Quantitative Analysis Center – part of the Allbritton Center for the Study of Public Life – the Wesleyan Media Project is the successor to the Wisconsin Advertising Project, which disbanded in 2009. It is directed by Erika Franklin Fowler, associate professor of government at Wesleyan University, Michael M. Franz, associate professor of government at Bowdoin College and Travis N. Ridout, professor of political science at Washington State University. WMP staff include Laura Baum (Project Manager), Dolly Haddad (Project Coordinator) and Matthew Motta (Research Associate).

The Wesleyan Media Project is supported by grants from The John S. and James L. Knight Foundation and Wesleyan University. Data provided by Kantar Media/CMAG with analysis by the Wesleyan Media Project using Academiclip, a web-based coding tool. The Wesleyan Media Project is partnering this year with both the Center for Responsive Politics, to provide added information on outside group disclosure, and Ace Metrix, to assess ad effectiveness.

Periodic releases of data will be posted on the project’s website and dispersed via Twitter @wesmediaproject.

![]()

For more information contact:

Heather Tolley-Bauer, htolleybauer@wesleyan.edu, (860) 398-9018

![]()

About Wesleyan University

Wesleyan University, in Middletown, Conn., is known for the excellence of its academic and co-curricular programs. With more than 2,900 undergraduates and 200 graduate students, Wesleyan is dedicated to providing a liberal arts education characterized by boldness, rigor and practical idealism. For more, visit www.wesleyan.edu.

About the John S. and James L. Knight Foundation

Knight Foundation supports transformational ideas that promote quality journalism, advance media innovation, engage communities and foster the arts. We believe that democracy thrives when people and communities are informed and engaged. For more, visit www.knightfoundation.org.

About the Center for Responsive Politics

The Center for Responsive Politics is the nation’s premier research group tracking money in U.S. politics and its effect on elections and public policy. Nonpartisan, independent and nonprofit, the organization aims to create a more educated voter, an involved citizenry and a more transparent and responsive government. CRP’s award-winning website, OpenSecrets.org, is the most comprehensive resource available anywhere for federal campaign contribution and lobbying data and analysis.

![]()

Appendix

![]()

Table A1: Presidential General Election Ad Volumes by Sponsor,

2012 & 2016 (Oct 14-Oct 30)

| 2012 Pro-Obama | 2016 Pro-Clinton | 2012 Pro-Romney | 2016 Pro-Trump |

||

|---|---|---|---|---|---|

| Cand | 82,481 | 48,444 | 42,536 | 30,407 | |

| Group | 15,434 | 17,486 | 48,669 | 6,191 | |

| Party/Coord. | 0 | 475 | 3,866 | 0 | |

| Total | 97,915 | 66,405 | 95,071 | 36,598 | |

| Figures are from Oct 14 to October 30 for each cycle. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||

![]()

Table A2: Tone of Presidential General Election Advertising

| Negative % | Contrast % | Positive % | |

|---|---|---|---|

| 2000 | 21.04 | 35.09 | 43.87 |

| 2004 | 45.77 | 26.88 | 27.35 |

| 2008 | 50.62 | 21.59 | 27.79 |

| 2012 | 63.76 | 24 | 12.24 |

| 2016 | 51.51 | 25.04 | 23.45 |

| Figures are from June 8 to October 30 of each year. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||

![]()

Figure A1: Tone of Presidential Advertising (Oct 14 – Oct 30)

![]()

Table A3: Ad Volume and Spending in US Senate Races (Sept 5 – Oct 30)

| State | Airings | Est. Cost (in Ms) | Dem Adv | Dem Cand | Pro-Dem Party/ Coord | Pro-Dem Grp | Rep Cand | Pro-Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| AK | 1,184 | 0.2 | (1,145) | 0 | 0 | 0 | 1,145 | 0 | 0 |

| AR | 5,104 | 1.7 | (776) | 2,164 | 0 | 0 | 2,940 | 0 | 0 |

| AZ | 11,211 | 6.1 | (1,627) | 4,792 | 0 | 0 | 3,556 | 2,321 | 542 |

| CA | 2,161 | 3.4 | 2,161 | 1,487 | 0 | 674 | 0 | 0 | 0 |

| CO | 4,748 | 2.5 | 2,016 | 3,382 | 0 | 0 | 1,057 | 0 | 309 |

| CT | 1,843 | 1.1 | 1,843 | 1,843 | 0 | 0 | 0 | 0 | 0 |

| FL | 34,794 | 26.5 | (12,800) | 7,372 | 208 | 3,417 | 12,126 | 2,102 | 9,569 |

| GA | 8,325 | 4.0 | (4,621) | 1,852 | 0 | 0 | 6,067 | 0 | 406 |

| HI | 545 | 0.2 | 545 | 545 | 0 | 0 | 0 | 0 | 0 |

| IA | 5,304 | 1.8 | (4,452) | 426 | 0 | 0 | 4,878 | 0 | 0 |

| ID | 4,046 | 0.7 | (4,030) | 8 | 0 | 0 | 4,038 | 0 | 0 |

| IL | 12,709 | 10.5 | 3,387 | 8,048 | 0 | 0 | 2,113 | 644 | 1,904 |

| IN | 48,199 | 24.8 | 9,319 | 13,808 | 7,597 | 7,354 | 6,322 | 3,432 | 9,686 |

| KS | 2,220 | 0.8 | (2,220) | 0 | 0 | 0 | 2,220 | 0 | 0 |

| KY | 8,191 | 2.9 | 2,193 | 4,696 | 0 | 496 | 1,421 | 983 | 595 |

| LA | 17,014 | 7.9 | (11,293) | 2,799 | 0 | 37 | 12,044 | 0 | 2,085 |

| MD | 871 | 0.6 | 871 | 871 | 0 | 0 | 0 | 0 | 0 |

| MO | 44,984 | 26.8 | 1,384 | 5,903 | 8,907 | 8,374 | 10,819 | 2,023 | 8,958 |

| NC | 50,678 | 23.5 | 14,974 | 11,675 | 13,491 | 7,660 | 6,571 | 4,037 | 7,244 |

| ND | 1,529 | 0.4 | (1,529) | 0 | 0 | 0 | 1,529 | 0 | 0 |

| NH | 29,793 | 58.1 | 5,247 | 4,515 | 6,726 | 6,279 | 4,517 | 681 | 7,075 |

| NV | 40,613 | 26.9 | 5,303 | 6,919 | 6,617 | 9,422 | 3,723 | 3,807 | 10,125 |

| NY | 5,076 | 4.2 | 5,056 | 5,066 | 0 | 0 | 0 | 0 | 10 |

| OH | 18,281 | 10.1 | (12,335) | 2,866 | 107 | 0 | 10,762 | 1,056 | 3,490 |

| OK | 252 | 0.1 | (252) | 0 | 0 | 0 | 252 | 0 | 0 |

| OR | 3,760 | 2.0 | 3,760 | 3,760 | 0 | 0 | 0 | 0 | 0 |

| PA | 57,049 | 45.2 | 9,809 | 10,701 | 8,203 | 14,525 | 8,478 | 2,313 | 12,829 |

| SC | 1,447 | 0.4 | (1,447) | 0 | 0 | 0 | 1,447 | 0 | 0 |

| UT | 269 | 0.1 | (269) | 0 | 0 | 0 | 269 | 0 | 0 |

| VT | 683 | 0.2 | 683 | 683 | 0 | 0 | 0 | 0 | 0 |

| WA | 3,148 | 2.3 | 3,148 | 3,148 | 0 | 0 | 0 | 0 | 0 |

| WI | 27,149 | 11.2 | 2,869 | 12,027 | 2,380 | 602 | 6,711 | 1,400 | 4,029 |

| Figures are from September 5 to October 30, 2016 and may include some primary advertising activity. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||||||

![]()

Table A4: Ad Volume and Spending in Top US House Races (Sept 5 – Oct 30)

| District | Airings | Est. Cost (in Ms) | Dem Adv | Dem Cand | Pro-Dem Grp | Pro-Dem Party/ Coord | Rep Cand | Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| AK01 | 3,335 | 0.5 | 2,455 | 2,895 | 0 | 0 | 440 | 0 | 0 |

| AL02 | 122 | 0 | -122 | 0 | 0 | 0 | 122 | 0 | 0 |

| AL06 | 16 | 0 | -16 | 0 | 0 | 0 | 16 | 0 | 0 |

| AR02 | 351 | 0.1 | -261 | 0 | 45 | 0 | 306 | 0 | 0 |

| AZ01 | 4,713 | 2.8 | 3,427 | 1,151 | 276 | 2,643 | 492 | 151 | 0 |

| AZ02 | 6,687 | 2.2 | -2,265 | 2,211 | 0 | 0 | 4,027 | 0 | 449 |

| AZ09 | 1,396 | 0.9 | 1,396 | 1,211 | 185 | 0 | 0 | 0 | 0 |

| CA03 | 43 | 0 | 43 | 43 | 0 | 0 | 0 | 0 | 0 |

| CA06 | 45 | 0 | 45 | 45 | 0 | 0 | 0 | 0 | 0 |

| CA07 | 6,138 | 3.8 | 800 | 1,674 | 244 | 1,551 | 465 | 1,601 | 603 |

| CA10 | 5,141 | 3.2 | 1,621 | 211 | 0 | 3,170 | 1,070 | 0 | 690 |

| CA16 | 777 | 0.2 | 777 | 777 | 0 | 0 | 0 | 0 | 0 |

| CA17 | 1,172 | 1.4 | 1,172 | 1,172 | 0 | 0 | 0 | 0 | 0 |

| CA20 | 1,372 | 0.3 | 380 | 876 | 0 | 0 | 439 | 0 | 57 |

| CA21 | 6,911 | 2.2 | -1,023 | 0 | 2,944 | 0 | 3,651 | 0 | 316 |

| CA24 | 8,781 | 1.4 | -151 | 2,584 | 1,731 | 0 | 2,138 | 2,328 | 0 |

| CA25 | 726 | 1 | 644 | 0 | 0 | 685 | 0 | 41 | 0 |

| CA33 | 6 | 0 | -6 | 0 | 0 | 0 | 6 | 0 | 0 |

| CA36 | 3,498 | 0.6 | 3,498 | 3,498 | 0 | 0 | 0 | 0 | 0 |

| CA49 | 7,912 | 3.6 | 2,500 | 0 | 423 | 4,783 | 2,706 | 0 | 0 |

| CA52 | 2,607 | 1.5 | 639 | 1,463 | 160 | 0 | 984 | 0 | 0 |

| CA53 | 3 | 0 | -3 | 0 | 0 | 0 | 3 | 0 | 0 |

| CO02 | 150 | 0.2 | 150 | 150 | 0 | 0 | 0 | 0 | 0 |

| CO03 | 5,347 | 2.5 | -443 | 1,269 | 1,183 | 0 | 1,593 | 577 | 725 |

| CO05 | 10 | 0 | 10 | 10 | 0 | 0 | 0 | 0 | 0 |

| CO06 | 8,133 | 6.8 | 693 | 940 | 599 | 2,874 | 1,065 | 2,520 | 135 |

| CT05 | 337 | 0.2 | 337 | 337 | 0 | 0 | 0 | 0 | 0 |

| DE01 | 515 | 0.5 | 515 | 489 | 26 | 0 | 0 | 0 | 0 |

| FL01 | 1 | 0 | 1 | 1 | 0 | 0 | 0 | 0 | 0 |

| FL03 | 335 | 0.1 | 147 | 241 | 0 | 0 | 94 | 0 | 0 |

| FL06 | 392 | 0.3 | -392 | 0 | 0 | 0 | 392 | 0 | 0 |

| FL07 | 3,224 | 2.3 | 1,348 | 0 | 509 | 1,777 | 338 | 600 | 0 |

| FL12 | 14 | 0 | -14 | 0 | 0 | 0 | 14 | 0 | 0 |

| FL13 | 2,429 | 2.2 | 2,297 | 794 | 952 | 609 | 58 | 0 | 0 |

| FL18 | 10,575 | 5.3 | 425 | 5,500 | 0 | 0 | 251 | 3,170 | 1,654 |

| FL25 | 220 | 0.2 | -220 | 0 | 0 | 0 | 166 | 0 | 54 |

| FL26 | 6,483 | 6.6 | -147 | 328 | 688 | 2,152 | 798 | 1,755 | 762 |

| FL27 | 799 | 0.6 | -131 | 334 | 0 | 0 | 465 | 0 | 0 |

| HI01 | 109 | 0 | 109 | 109 | 0 | 0 | 0 | 0 | 0 |

| IA01 | 8,047 | 2.7 | 767 | 1,755 | 1,010 | 1,642 | 1,789 | 1,600 | 251 |

| IA03 | 8,199 | 2.8 | 391 | 1,471 | 0 | 2,823 | 1,633 | 1,311 | 959 |

| ID01 | 537 | 0.1 | -125 | 206 | 0 | 0 | 331 | 0 | 0 |

| IL08 | 352 | 0.6 | 352 | 352 | 0 | 0 | 0 | 0 | 0 |

| IL10 | 5,405 | 10.9 | 539 | 571 | 582 | 1,819 | 1,665 | 768 | 0 |

| IL12 | 1,543 | 0.9 | -129 | 707 | 0 | 0 | 829 | 7 | 0 |

| IL13 | 158 | 0.1 | -158 | 0 | 0 | 0 | 158 | 0 | 0 |

| IL17 | 961 | 0.2 | 961 | 961 | 0 | 0 | 0 | 0 | 0 |

| IN02 | 2,725 | 0.8 | -665 | 1,030 | 0 | 0 | 1,695 | 0 | 0 |

| IN03 | 54 | 0 | -54 | 0 | 0 | 0 | 54 | 0 | 0 |

| IN07 | 123 | 0.1 | 123 | 123 | 0 | 0 | 0 | 0 | 0 |

| IN09 | 5,740 | 3.1 | -734 | 1,649 | 836 | 18 | 2,390 | 730 | 117 |

| KS01 | 156 | 0.1 | -58 | 0 | 0 | 0 | 58 | 0 | 0 |

| KS02 | 253 | 0.1 | -253 | 0 | 0 | 0 | 253 | 0 | 0 |

| KS03 | 3,340 | 1.6 | -44 | 424 | 0 | 1,224 | 1,648 | 1 | 43 |

| KS04 | 522 | 0.2 | -368 | 34 | 0 | 0 | 402 | 0 | 0 |

| KY06 | 1,918 | 0.7 | -1,252 | 333 | 0 | 0 | 1,585 | 0 | 0 |

| LA01 | 307 | 0.2 | -305 | 0 | 0 | 0 | 305 | 0 | 0 |

| LA03 | 764 | 0.4 | -764 | 0 | 0 | 0 | 764 | 0 | 0 |

| LA04 | 2,097 | 0.7 | -1,957 | 70 | 0 | 0 | 1,996 | 0 | 31 |

| LA06 | 311 | 0.2 | -311 | 0 | 0 | 0 | 311 | 0 | 0 |

| MD02 | 159 | 0.1 | 159 | 159 | 0 | 0 | 0 | 0 | 0 |

| MD06 | 728 | 1.4 | -74 | 327 | 0 | 0 | 0 | 0 | 401 |

| ME01 | 22 | 0 | -22 | 0 | 0 | 0 | 22 | 0 | 0 |

| ME02 | 19,706 | 6.3 | 3,790 | 5,031 | 4,177 | 2,540 | 3,515 | 3,858 | 585 |

| MI01 | 315 | 0.1 | -315 | 0 | 0 | 0 | 0 | 315 | 0 |

| MI06 | 2,820 | 1.4 | -382 | 1,219 | 0 | 0 | 1,601 | 0 | 0 |

| MI07 | 6,516 | 2 | 1,736 | 3,855 | 271 | 0 | 1,790 | 451 | 149 |

| MI08 | 2,828 | 1.6 | 702 | 775 | 0 | 990 | 835 | 0 | 228 |

| MI11 | 471 | 0.5 | -373 | 49 | 0 | 0 | 422 | 0 | 0 |

| MN02 | 5,996 | 5.2 | 2,832 | 2,150 | 665 | 1,599 | 123 | 1,459 | 0 |

| MN03 | 6,645 | 5.4 | 1,755 | 1,511 | 0 | 2,689 | 2,084 | 361 | 0 |

| MN08 | 12,197 | 10.6 | 2,847 | 1,649 | 1,838 | 4,035 | 1,603 | 1,606 | 1,466 |

| MT01 | 17,560 | 1.8 | -2 | 8,466 | 313 | 0 | 8,781 | 0 | 0 |

| NC02 | 216 | 0.1 | -216 | 0 | 0 | 0 | 216 | 0 | 0 |

| NC08 | 277 | 0.2 | -231 | 23 | 0 | 0 | 254 | 0 | 0 |

| NC13 | 309 | 0.1 | -309 | 0 | 0 | 0 | 309 | 0 | 0 |

| ND01 | 142 | 0 | -142 | 0 | 0 | 0 | 142 | 0 | 0 |

| NE02 | 8,762 | 3.4 | 506 | 2,093 | 851 | 1,690 | 801 | 2,965 | 362 |

| NH01 | 1,380 | 0.7 | -276 | 463 | 0 | 0 | 134 | 605 | 0 |

| NH02 | 912 | 0.6 | 912 | 912 | 0 | 0 | 0 | 0 | 0 |

| NJ02 | 252 | 0.2 | -252 | 0 | 0 | 0 | 252 | 0 | 0 |

| NJ03 | 518 | 0.2 | -518 | 0 | 0 | 0 | 518 | 0 | 0 |

| NJ05 | 950 | 2.5 | 346 | 631 | 0 | 17 | 302 | 0 | 0 |

| NM01 | 810 | 0.4 | 810 | 810 | 0 | 0 | 0 | 0 | 0 |

| NM03 | 757 | 0.2 | 757 | 757 | 0 | 0 | 0 | 0 | 0 |

| NV01 | 165 | 0.1 | 165 | 165 | 0 | 0 | 0 | 0 | 0 |

| NV02 | 138 | 0 | 138 | 138 | 0 | 0 | 0 | 0 | 0 |

| NV03 | 8,097 | 6.2 | 359 | 617 | 1,033 | 2,578 | 297 | 1,898 | 1,674 |

| NV04 | 7,055 | 4.6 | 243 | 608 | 221 | 2,820 | 1 | 3,405 | 0 |

| NY01 | 131 | 0.2 | 131 | 131 | 0 | 0 | 0 | 0 | 0 |

| NY19 | 9,236 | 3.3 | -122 | 2,079 | 650 | 1,828 | 672 | 2,707 | 1,300 |

| NY20 | 36 | 0 | 36 | 36 | 0 | 0 | 0 | 0 | 0 |

| NY21 | 4,501 | 0.9 | 987 | 2,744 | 0 | 0 | 1,757 | 0 | 0 |

| NY22 | 15,066 | 3 | 9,870 | 4,462 | 5,959 | 964 | 415 | 1,100 | 0 |

| NY23 | 2,752 | 0.8 | 64 | 1,408 | 0 | 0 | 1,344 | 0 | 0 |

| NY24 | 9,610 | 2.2 | 818 | 960 | 372 | 3,882 | 2,055 | 1,379 | 962 |

| NY25 | 2,277 | 0.4 | 1,219 | 1,748 | 0 | 0 | 529 | 0 | 0 |

| OH10 | 46 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| OH15 | 446 | 0.3 | -446 | 0 | 0 | 0 | 446 | 0 | 0 |

| OK04 | 128 | 0.1 | -128 | 0 | 0 | 0 | 128 | 0 | 0 |

| OR05 | 201 | 0.2 | 101 | 134 | 17 | 0 | 0 | 0 | 50 |

| PA08 | 6,382 | 6.9 | 2,408 | 412 | 526 | 3,457 | 459 | 1,116 | 412 |

| PA09 | 417 | 0.1 | -417 | 0 | 0 | 0 | 417 | 0 | 0 |

| PA11 | 57 | 0 | 57 | 57 | 0 | 0 | 0 | 0 | 0 |

| PA12 | 725 | 0.4 | -725 | 0 | 0 | 0 | 725 | 0 | 0 |

| PA15 | 54 | 0 | -54 | 0 | 0 | 0 | 54 | 0 | 0 |

| PA16 | 1,589 | 0.6 | 451 | 807 | 0 | 213 | 527 | 0 | 42 |

| RI02 | 293 | 0.1 | 293 | 293 | 0 | 0 | 0 | 0 | 0 |

| SC04 | 18 | 0 | -18 | 0 | 0 | 0 | 18 | 0 | 0 |

| SC05 | 553 | 0.3 | 133 | 343 | 0 | 0 | 210 | 0 | 0 |

| SD01 | 83 | 0 | 83 | 83 | 0 | 0 | 0 | 0 | 0 |

| TN06 | 253 | 0.1 | -253 | 0 | 0 | 0 | 253 | 0 | 0 |

| TN08 | 211 | 0.1 | -211 | 0 | 0 | 0 | 211 | 0 | 0 |

| TX08 | 4 | 0 | -4 | 0 | 0 | 0 | 4 | 0 | 0 |

| TX23 | 11,180 | 8.1 | 2,810 | 1,463 | 931 | 4,601 | 1,672 | 1,929 | 584 |

| TX27 | 35 | 0 | 35 | 35 | 0 | 0 | 0 | 0 | 0 |

| UT01 | 271 | 0.1 | 271 | 168 | 103 | 0 | 0 | 0 | 0 |

| UT02 | 159 | 0.1 | -157 | 1 | 0 | 0 | 158 | 0 | 0 |

| UT04 | 5,488 | 2.6 | 108 | 2,631 | 0 | 167 | 2,633 | 0 | 57 |

| VA02 | 12 | 0 | -12 | 0 | 0 | 0 | 12 | 0 | 0 |

| VA05 | 5,256 | 1 | 1,766 | 3,467 | 0 | 44 | 1,230 | 0 | 515 |

| VA07 | 56 | 0 | 40 | 48 | 0 | 0 | 8 | 0 | 0 |

| VA10 | 5,795 | 10.9 | 933 | 392 | 1,321 | 1,651 | 887 | 624 | 920 |

| WA03 | 426 | 0.2 | -426 | 0 | 0 | 0 | 426 | 0 | 0 |

| WA04 | 177 | 0 | -177 | 0 | 0 | 0 | 177 | 0 | 0 |

| WA05 | 451 | 0.1 | -301 | 75 | 0 | 0 | 376 | 0 | 0 |

| WA07 | 1,302 | 1.7 | 1,302 | 1,302 | 0 | 0 | 0 | 0 | 0 |

| WA08 | 239 | 0.4 | -239 | 0 | 0 | 0 | 239 | 0 | 0 |

| WI01 | 619 | 0.4 | -619 | 0 | 0 | 0 | 619 | 0 | 0 |

| WI06 | 446 | 0.1 | -446 | 0 | 0 | 0 | 446 | 0 | 0 |

| WI08 | 5,994 | 1.9 | -904 | 1,866 | 0 | 679 | 1,885 | 1,297 | 267 |

| WV02 | 530 | 0.1 | -368 | 81 | 0 | 0 | 449 | 0 | 0 |

| Figures are from September 5 to October 30, 2016 and may include some primary advertising activity. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||||||

![]()

Table A5: Ad Volume and Spending in Top Governor Races (Sept 5 – Oct 30)

| State | Airings | Est. Cost (in Ms) | Dem Adv | Dem Cand | Pro-Dem Party/ Coord | Pro-Dem Grp | Rep Cand | Rep Party/ Coord | Pro-Rep Grp |

|---|---|---|---|---|---|---|---|---|---|

| IN | 23,992 | 9.5 | 64 | 11,542 | 0 | 486 | 11,962 | 2 | 0 |

| MO | 33,864 | 12.1 | 1,167 | 17,492 | 0 | 0 | 16,239 | 0 | 86 |

| MT | 37,047 | 4.6 | -11,057 | 6,719 | 0 | 6,276 | 22,698 | 1,354 | 0 |

| NC | 36,102 | 16.5 | 10,814 | 18,594 | 0 | 4,864 | 8,571 | 4,062 | 11 |

| ND | 924 | 0.2 | -924 | 0 | 0 | 0 | 924 | 0 | 0 |

| NH | 4,292 | 6.4 | 1,692 | 577 | 1,271 | 1,144 | 756 | 0 | 544 |

| OR | 6,793 | 2.3 | 3,231 | 5,012 | 0 | 0 | 1,781 | 0 | 0 |

| UT | 667 | 0.4 | 393 | 530 | 0 | 0 | 137 | 0 | 0 |

| VT | 6,816 | 3 | -648 | 1,250 | 0 | 1,834 | 1,066 | 0 | 2,666 |

| WA | 5,066 | 4.9 | 3,748 | 3,153 | 0 | 1,254 | 659 | 0 | 0 |

| WV | 8,111 | 1.6 | 519 | 3,893 | 0 | 422 | 2,272 | 1,524 | 0 |

| Figures are from September 5 to October 30, 2016 and may include some primary advertising activity. Numbers include broadcast television, national network and national cable. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. |

|||||||||